Introduction

Why Personal Wealth Mastery Matters in 2025

2025 is the year of personal wealth empowerment. Inflation, rising living costs, and global uncertainty have forced individuals to rethink how they manage their money. No longer is it enough to simply track your income and expenses—real wealth mastery involves budgeting with precision, investing wisely, and hitting your long-term financial goals.

Whether you’re a freelancer, a salaried professional, a small business owner, or even a retiree, you need a tool that can give you full visibility and control over your wealth. That’s where Quicken steps in.

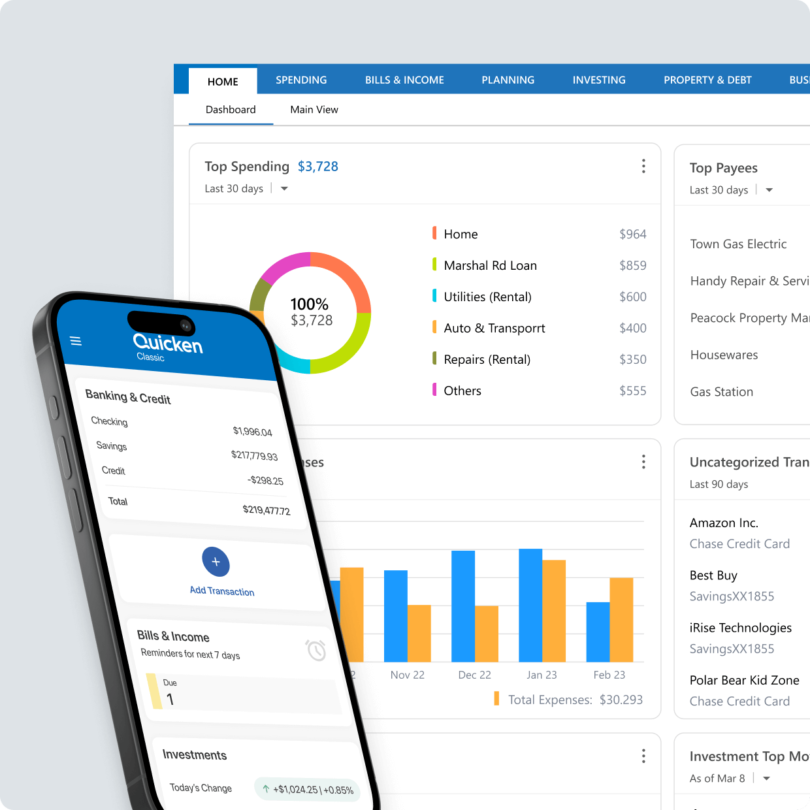

Think of it as your digital wealth manager—powerful, secure, and surprisingly easy to use. From setting monthly budgets to tracking stock performance, from visualizing your debt reduction to automating savings toward a dream home, Quicken brings everything under one dashboard.

If you’re serious about taking control of your wealth in 2025, this guide will show you exactly how Quicken can help.

What Is Quicken and Who Should Use It?

Quicken is a personal wealth management software that has been a leader in the market for over 35 years. Originally developed as a desktop budgeting tool, Quicken has evolved into a powerful cloud-connected suite that helps users:

- Track income, expenses, and savings

- Create and manage monthly budgets

- Monitor investments, mutual funds, and stocks

- Plan for life goals like retirement, education, or buying property

- Generate detailed wealth reports and projections

In 2025, Quicken supports both desktop and mobile platforms, allowing users to sync data in real time across devices. It’s ideal for:

- Individuals looking to master their personal wealth

- Couples or families planning budgets and future goals together

- Investors who want real-time portfolio tracking

- Business owners managing household and company wealth in one place

The best part? You don’t have to be a wealth expert to get started. With its clean interface, smart suggestions, and guided setup, Quicken makes wealth tracking simple for beginners and advanced for pros.

Getting Started with Quicken in 2025

Latest Features & Interface Improvements

Quicken’s 2025 edition is its most advanced yet. The software has undergone a major revamp in terms of performance, aesthetics, and AI-powered personalization.

Here’s what’s new:

- 🔍 Smart Wealth Dashboard – Visualize net worth, goal progress, and spending in one place

- 💬 AI-Powered Insights – Get personalized wealth suggestions based on habits

- 📲 Improved Mobile Sync – Real-time syncing across devices, no manual uploads

- 📊 Advanced Report Builder – Customize by tag, category, or account with drag-and-drop ease

- 🔐 Upgraded Security – Includes facial recognition login, multi-device authentication, and encrypted cloud backups

You also get pre-configured templates for:

- Monthly and annual budgeting

- Debt repayment timelines

- Wealth accumulation over time

- Tax estimations for different income brackets

Quicken’s interface now supports dark mode, voice commands, and touchscreen optimization—making it friendly across all user groups and devices.

Subscription Plans and Pricing Breakdown

In 2025, Quicken offers a tiered subscription model to suit different user needs. Here’s how it breaks down:

| Plan | Annual Cost (USD) | Features | Best For |

|---|---|---|---|

| Starter | $41.88 | Budget tracking, expense categorization | Beginners, students |

| Deluxe | $59.88 | Goals, savings plans, debt tracking | Families, side hustlers |

| Premier | $83.88 | Investment tracking, retirement planner, priority support | Investors, long-term planners |

| Home & Business | $119.88 | Business income/expense tracking, invoice generator | Freelancers, SMBs |

While the pricing is in USD, Quicken is fully usable globally, including India. Many Indian users opt for Premier or Home & Business plans for deeper tracking and integration with investment portfolios.

Pro Tip: Quicken often runs 40% off promotions for new users—check the official site or authorized resellers to save.

Budgeting Like a Pro Using Quicken

Setting Monthly Wealth Goals

Budgeting is no longer just about cutting costs—it’s about aligning spending with your wealth goals. Quicken helps you do that by letting you:

- Set custom monthly saving targets

- Define limits for discretionary and fixed categories

- Monitor your progress with real-time feedback

You can create goal-specific budgets, such as:

- Saving ₹50,000/month toward a down payment

- Cutting dining out costs by 30%

- Allocating a fixed % of income to investments

Quicken even allows you to set alerts when you’re nearing category limits or falling short of a saving goal.

Creating Smart Budgets for Every Expense Category

With Quicken, budgeting doesn’t feel restrictive—it feels empowering. Here’s why:

- It auto-categorizes expenses from bank feeds

- You can customize categories to fit Indian lifestyles (e.g., tuition, LIC, travel)

- Tagging lets you sort by person, project, or purpose

The built-in budget analyzer shows you:

- Monthly trends

- Categories eating up the most income

- Where you can trim to grow wealth

Using color-coded visualizations, you’ll see exactly where your money goes—and more importantly, where it should go instead.

Investment Tracking in Quicken

Real-Time Portfolio Sync

In 2025, investment management is a must for growing wealth—and Quicken delivers it effortlessly. You can link your:

- Demat accounts

- Mutual fund platforms

- US-based and global brokerage accounts

- Crypto wallets (via CSV or API integration)

Quicken supports real-time updates for stocks, mutual funds, ETFs, and fixed-income instruments. The auto-sync feature pulls prices, gains/losses, and asset allocation data into one dashboard.

Analyzing Returns and Wealth Growth Over Time

Tracking is one thing—analyzing is where the magic happens.

Quicken offers deep insights like:

- Time-weighted and dollar-weighted returns

- Benchmark comparisons (e.g., Nifty 50, S&P 500)

- Capital gains by holding period

- Tax implications across regions

You can also create simulated future wealth scenarios:

- “If I invest ₹20,000/month in ELSS for 15 years…”

- “If I stop SIPs and switch to PPF…”

The app gives you projected growth based on conservative, moderate, or aggressive returns. This way, you’re not just investing—you’re strategically building wealth.

Goal-Based Wealth Planning

How to Set Up Goals (House, Education, Retirement)

Wealth without purpose is just money sitting still. With Quicken’s Goal Planning Tools, users can define and chase multiple financial targets simultaneously—whether it’s a down payment on a home, saving for a child’s education, or retiring early.

Here’s how it works:

- Choose a Goal Type:

- Home purchase

- Higher education

- Retirement savings

- Emergency fund

- Vacation or wedding

- Debt payoff

- Define Your Goal Details:

- Target amount (e.g., ₹50 Lakh for a house)

- Timeframe (e.g., 7 years)

- Existing savings and monthly contribution

- Expected interest/growth rate

- Simulate Progress Scenarios:

Quicken visually displays whether you’re on track, behind, or ahead of your target using bar graphs, charts, and milestone alerts. - Link Accounts and Transactions:

You can connect your savings or investment account directly to each goal. As you invest or deposit money, Quicken tracks your progress in real time.

This dynamic wealth planner gives more than static numbers—it provides confidence. You can also add life changes (job switch, market dip) and instantly see how they affect your long-term wealth trajectory.

Monitoring Progress and Adjusting Plans

No plan survives contact with real life—and Quicken knows that. That’s why it allows for constant recalibration. As your income changes, or if you achieve goals early, you can:

- Adjust timelines or contribution amounts

- Transfer funds between goals

- Set new milestones or sub-goals

Quicken also sends real-time alerts if you fall behind or overspend in categories impacting your goals. This helps users stay proactive—not reactive—about their wealth.

Quicken Mobile App for Wealth on the Go

Sync Across Devices

In 2025, wealth management can’t be confined to a laptop screen. Quicken’s mobile app (available on both Android and iOS) ensures your entire financial life travels with you—securely.

With cloud sync, anything you enter or change on your phone reflects immediately across all linked devices. Whether you’re reviewing your retirement progress during a train ride or logging an expense after shopping, the app keeps everything connected.

What you can do from the mobile app:

- Log expenses with a single tap

- Upload and tag receipts instantly

- Check budget vs. actual spending

- Review investment performance

- Approve transactions and sync with banks

The interface is optimized for mobile, offering a dashboard view for net worth, savings, cash flow, and alerts—all at your fingertips.

Alerts, Reports, and Real-Time Wealth Dashboards

With Quicken mobile, you get custom push notifications for:

- Budget overspending

- Unexpected account changes

- Goal progress updates

- Investment loss thresholds

- Upcoming bill reminders

This proactive system helps you fix issues as they happen—not after. Plus, the in-app mini reports give quick visuals like pie charts and bar graphs to show:

- Spending by category

- Investment growth over time

- Goal achievement percentages

Busy professionals, entrepreneurs, and digital nomads especially benefit from the app’s portability and on-demand visibility.

Advanced Tools for Wealth Builders

Quicken’s Tax Estimator and Savings Projections

Wealth mastery isn’t just about growing your money—it’s about keeping more of it, too. That’s why Quicken’s 2025 Premier and Home & Business plans include powerful tax forecasting and savings simulators.

Tax Estimator:

Automatically calculates estimated taxes based on:

- Income sources (salary, freelance, rental, capital gains)

- Investments and dividends

- Deductions (home loan interest, 80C, HRA)

- Tax-saving instruments (ELSS, NPS, etc.)

This helps you:

- Avoid underpaying taxes

- Plan quarterly advance tax

- Optimize investments for tax-saving potential

Savings Projections Tool:

This visual calculator helps simulate different savings scenarios:

- “What if I save ₹25,000/month for 10 years at 9% return?”

- “How fast can I reach ₹1 Crore if I double my SIP?”

- “How much should I save monthly to retire at 50?”

These tools transform vague ideas into actionable, data-backed decisions—giving users true control over their wealth.

Using Tags, Reports, and Visualizations to Refine Strategy

Quicken supports tags, which are beyond just categories. You can tag expenses and income by:

- Project (Home Renovation, Wedding, Freelance Work)

- Family member (Self, Spouse, Child)

- Purpose (Wealth Building, Emergency, Lifestyle)

This gives you ultra-detailed reports that are customized to your lifestyle. For example:

- Total family health expenses over a year

- Business vs. personal travel costs

- Passive income vs. active earnings

Add in dynamic visuals—pie charts, bar graphs, net worth trackers—and you’ll begin seeing patterns and insights that no spreadsheet can provide.

Quicken vs. Competitors in Wealth Management

Quicken vs. Mint vs. YNAB

Here’s how Quicken stacks up against popular alternatives in 2025:

| Feature | Quicken | Mint | YNAB (You Need a Budget) |

|---|---|---|---|

| Wealth Dashboard | ✔✔✔ | ✔ | ✔✔ |

| Investment Tracking | ✔✔✔ | ✔ | ❌ |

| Goal-Based Planning | ✔✔✔ | ✔✔ | ✔✔ |

| Offline Access | ✔✔ | ❌ | ✔ |

| Indian Bank Sync | ✔✔ (manual or CSV) | ❌ | ❌ |

| Business Tools | ✔✔✔ | ❌ | ❌ |

While Mint is free and user-friendly, it lacks the depth and flexibility that serious wealth builders require. YNAB is great for strict budgeting but doesn’t support investments or long-term planning.

Quicken wins by offering the full spectrum of wealth management—from daily budgeting to future forecasting.

Why Quicken Stands Out in 2025

- Hybrid access (cloud + local desktop)

- Business + personal tracking in one account

- Robust goal planning and simulation tools

- AI insights + advanced reporting

- Trusted for over 35 years by millions globally

Whether you’re managing ₹5 Lakh or ₹5 Crore in assets, Quicken scales to fit your wealth level and complexity.

Common Mistakes Users Make and How to Avoid Them

Overcomplicating Wealth Categories

One of the biggest hurdles new Quicken users face is setting up too many categories. While it’s tempting to track every single expense down to “chai at the office canteen,” overcomplicating your category tree can actually hurt your clarity and productivity.

Here’s how to avoid it:

- Stick to 10–15 master categories (e.g., groceries, travel, utility bills, education, savings, investments)

- Use tags instead of creating sub-categories (e.g., tag “Diwali” or “Work Trip” instead of making new folders)

- Keep it functional, not forensic—the goal is to understand trends, not scrutinize every penny

Simplified categories help you:

- Generate clearer reports

- Spot patterns faster

- Spend less time managing and more time optimizing

Ignoring Cash Flow Trends

Many users focus too much on expense tracking and ignore one of Quicken’s most powerful tools: cash flow visualization. This chart shows you how much money is coming in, going out, and growing over time.

Don’t overlook these common signs of cash flow issues:

- High month-to-month fluctuations

- Large “miscellaneous” spend with no tags

- Negative cash flow even when income is rising

To fix this:

- Track fixed vs. variable expenses

- Set automated savings goals that work around your cash cycles

- Use Quicken’s cash flow alerts to prevent overdrafts or liquidity gaps

This isn’t just wealth tracking—it’s wealth correction in real time.

Integrating Quicken with Banks and Investment Platforms

Safe Sync with Top Indian and Global Banks

Quicken supports both automatic and manual syncing. For U.S.-based users, integration with banks is instant and seamless. For Indian users, while direct API integration is limited, you can:

- Upload CSVs from ICICI, SBI, HDFC, Axis, and Kotak

- Use bank rules and categories to auto-sort transactions

- Reconcile bank balances easily with semi-auto import

For investment accounts like Zerodha, Groww, or Upstox:

- Export holdings in CSV

- Upload directly into Quicken’s investment panel

- Use ticker symbols to enable live price updates

Security is a top concern. Quicken 2025 includes:

- 256-bit encryption

- Two-factor authentication

- Automatic backups on the cloud and local machine

Your data remains private, secure, and accessible only to you.

How to Track Crypto and Alternate Investments

If you’re invested in Bitcoin, Ethereum, or mutual funds outside traditional stock markets, Quicken allows for flexible wealth tracking:

- Use manual accounts for gold, land, crypto, startups, or P2P lending

- Add real-time tickers for BTC, ETH, etc.

- Track price appreciation, ROI, and growth forecasts

With the “Custom Assets” tool, you can also assign value to:

- Art collections

- Business equity

- ESOPs or vested RSUs

This makes Quicken an all-in-one net worth tracker—not just a budget tool.

How to Use Quicken for Family or Small Business Wealth

Multi-User Setup and Shared Dashboards

In 2025, families and entrepreneurs alike are looking for shared visibility and collaboration. Quicken supports multi-user access (depending on your plan) so that:

- Spouses or partners can track shared goals

- Parents can tag child-related expenses separately

- Businesses can segregate operational vs. personal wealth

You can assign different permission levels:

- View-only for accountants

- Full-access for co-managers

- Budget-only access for assistants

Dashboards can be tailored per user. This makes it ideal for:

- Joint families managing shared expenses

- SMBs managing income, salaries, GST, and overheads

- Couples building joint savings goals

Managing Business and Personal Wealth Together

If you’re a solopreneur or side-hustler, it’s hard to draw the line between personal and business wealth. Quicken Home & Business solves this with:

- Dual ledgers

- Business invoice generator

- Profit & loss reports

- Tax-deductible tagging

- GST/VAT inclusion (for non-U.S. markets)

No need for two apps—just smartly separated accounts and reporting under one system.

Security and Data Privacy in Quicken

Encryption, Backups, and Multi-Factor Authentication

In an age of data breaches and digital theft, managing your wealth online demands top-tier security—and Quicken takes this seriously.

Key features:

- 256-bit AES encryption for both stored and transmitted data

- Automatic daily backups (cloud + local)

- Two-factor authentication (2FA) via app or SMS

- Optional password locks on specific accounts or dashboards

- No third-party ad or data sharing

You can even set up audit trails to track changes, logins, and exports—ideal for professionals handling multiple users or accounts.

Bottom line: Quicken is as secure as it is powerful.

Real User Reviews and Success Stories

How Real People Transformed Their Wealth Planning with Quicken

Don’t just take our word for it—here’s what everyday users are saying about how Quicken helped them master their wealth:

“I used to live paycheck to paycheck. After setting monthly goals on Quicken, I’ve saved ₹2.5 lakh in just 10 months.”

— Aditya S., Pune

“As a freelance designer juggling multiple clients, I needed a way to track payments and plan for taxes. Quicken Home & Business saved my sanity.”

— Ria M., Delhi

“I never thought I could track crypto, real estate, and stocks in one place—until I set up custom assets in Quicken. My wealth dashboard now feels complete.”

— Kevin J., Singapore

From solo earners to growing families, from investors to entrepreneurs—Quicken is helping people everywhere take back control of their wealth story.

Expert Tips for Maximizing Quicken in 2025

Hidden Tools Most Users Miss

- Debt Reduction Planner – Simulates avalanche vs. snowball payoff methods

- Income Forecast Tool – Projects next 12 months of cash flow

- Calendar View – Shows upcoming bills, income, and investment events

- Watch List Tickers – Monitor investments before you buy

Automating Wealth Building Tasks

Let Quicken do the heavy lifting:

- Set auto-categorization rules based on merchants or payment types

- Create monthly wealth reports that email to you

- Use auto-save rules to suggest bank transfers when surplus income is detected

- Schedule goal reviews every quarter with reminders

These smart automations keep your wealth growing—even when you’re not watching.

Conclusion

Wealth mastery in 2025 isn’t about being a finance expert—it’s about using the right tools to make smarter, faster, and more intentional money decisions. Quicken is that tool.

Whether you’re a student tracking expenses, a parent planning for a child’s education, an investor building assets, or a freelancer juggling bills and invoices—Quicken brings all your wealth management needs under one roof.

It’s time to ditch spreadsheets and second-guessing. Embrace clarity, confidence, and total wealth control with Quicken.

FAQs

Is Quicken suitable for Indian users in 2025?

Yes. While Quicken is U.S.-developed, Indian users can easily import bank and investment data via CSV and use manual tracking with smart automation.

Can I use Quicken without linking my bank?

Absolutely. Quicken supports manual entry and data upload, which is perfect for users who prefer offline management or bank privacy.

How is Quicken different from other wealth apps?

Unlike most budgeting apps, Quicken offers deep goal planning, investment tracking, business tools, and tax simulations—all in one ecosystem.

What is the best Quicken plan for investors?

The Premier plan is best for wealth builders, as it includes full investment tracking, retirement simulators, and tax planning tools.

Can Quicken handle cryptocurrency portfolios?

Yes. You can add custom crypto assets, track daily price movements, and project future value using investment simulation tools.